With a potential Fed rate cut in focus, markets remain perched between bullish momentum as well as political and central banks uncertainty. Key inflation figures, central bank decisions, and global political shifts could be the major volatility triggers, defining the overall risk landscape. As liquidity is low in summer, careful risk positioning and awareness of geopolitical events such as the Middle East tensions are essential.

Key Catalysts:

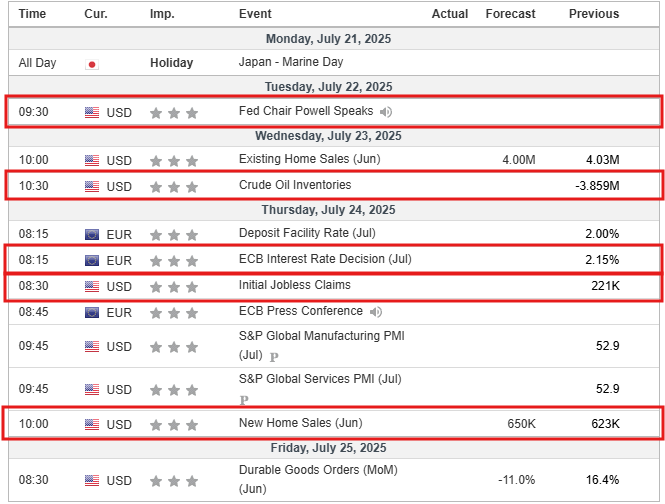

- U.S. CPI/PPI data & Fed commentary: Crucial for Fed rate-cut outlook.

- Trade headlines related to Trump’s tariff decisions impacting safe-haven flows.

- Geopolitical updates including Middle Eastern tensions that can sway gold demand

KEY ECONOMC INDICATORS & NEWS HEADLINES

Currencies

- The U.S. dollar weakens as Fed rate cut seems imminent

- With the Japanese upper-house election looming, the Japanese Yen will depend on the political outcomes and the monetary policy trajectory of the U.S. for more clarity

- Global dialogue continues in the G20 finance meeting on U.S. tariffs concerns

- ECB likely holds rates steady on July 23–24

- Turkish Lira reacts as the TCMB is expected to slash rates by 250 bps on July 24

Commodities

- Crude oil prices rallied after drone strikes in the Iraqi Kurdistan, as concerns about Middle East supply routes revived

- Gold eases after some strength in the U.S. dollar and bond yields trimmed safe-haven demand, though its trajectory remains linked to Fed and tariff headlines

Equities

- S&P 500 and Nasdaq near record highs, led by strong earnings and corporate buybacks. Notably, Citadel says U.S. firms will repurchase $1T in stock this year

- Global stock markets showing stronger risk appetite while supported by robust U.S. market data

- Asian equities stabilise alongside the strength in Wall Street, with markets in Tokyo, Hong Kong and Shanghai all rose on Friday

MARKET MOVERS

USD/JPY

USD/JPY remains bullish but faces a critical test at the 150.00 level. Election-induced yen volatility and developments from the Fed and tariff concerns may heighten intraday swings. With the USD/JPY being expected to start the week in the 148.40 to148.60 range, a few scenarios may play out for traders.

- Buy position: Target 1 150.00 to 150.50 / Target 2 152.00 to153.00 with stop loss placed below 147.80

- Sell position: Target 1 145.85 / Target 2 143.75 with stop loss placed above 150.20

- Range scalping: Buy and sell between 148.00 and 150.00 until breakout clarity emerges

Key price levels to observe include:

- Primary: 148.00, the rising trendline and short-term support

- Secondary: 147.15 to 147.30, lower support zone that would invalidate bullish momentum

- Tertiary: 145.85 to 145.00, deeper slack if technical structure weakens

EUR/USD

The EUR/USD is projected to open between 1.1740 to 1.1760, supported by the U.S. dollar softness ahead of the Fed decision coming Wednesday, as well as a dovish ECB sentiment.

- Buy position: Subject to a daily close above 1.1820 confirming the continuation of a bullish breakout, look out for Target 1 1.1850 / Target 2 1.1900 to 1.2000 with stop loss placed below 1.1720

- Sell position: With a failure at resistance or a drop below 1.1700, look out for Target 1 1.1650 / Target 2 1.1600 with stop loss placed above 1.1830

- Range scalping: Buy and sell between 1.1700 and 1.1800 until breakout clarity emerges

Key price levels to observe include:

- Primary: 1.1700 to 1.1720, minor support from congestion and recent swing lows

- Secondary: 1.1650 to 1.1670, broader consolidation region

- Tertiary: 1.1600 to 1.1620, deeper mean-reversion zone if weakness intensifies

XAU/USD

Gold is consolidating inside an ascending triangle pattern, bounded by support around $3,320 to $3,330 and resistance near $3,375. A breakout above would signal renewed bullish momentum, while a drop below $3,320 may trigger a deeper correction. Expect a range-bound open between $3,330 and $3,340, with markets reacting to U.S. inflation data and trade headlines.

- Buy position: Target 1 $3,450 / Target 2 $3,500 with stop loss placed below $3,320

- Sell position: Target 1 3,260 / Target 2 $3,200 with stop loss placed above $3,375

- Range scalping: Buy and sell between $3,330 and $3,375 until breakout clarity emerges

Key price levels to observe include:

- Primary: $3,320 to $3,330, the level forming triangle base as well as the 50-day SMA support

- Secondary: $3,300 to $3,310, the lower channel zone whereby a breach suggests bearish follow-through

- Tertiary: $3,245 to $3,260 is a deeper support if both above levels fail

Click here to open account and start trading.